For the first time, advances in data aggregation and AI are letting organizations see the entire customer journey, from the first interaction to renewal and expansion. This makes it possible to understand not just what customers do, but why they act and when they’re most likely to engage. Those able to harness these Customer Journey Insights will win thanks to their ability to turn every signal into trust and value.

At the latest Finovate conference in New York, the conversation centered on customer experience and the growing role of AI in finance. U.S. Bank and Citi discussed how they are using AI to personalize engagement and make interactions more relevant. Yet the real opportunity goes further toward what we call Customer Journey Insights. A continuum of sales, onboarding, and success operating as one connected system powered by shared data, context, and intent. In this model, CX evolves from a service function into a building block of the larger revenue journey.

What We Heard

Finovate made it clear that personalization is no longer a differentiator but the new baseline. What comes next is aggregation. Today, most institutions still monitor the customer journey through disconnected systems: CRMs for acquisition, CSAT and NPS programs for service, and BI tools for reporting. The future belongs to those who can connect those signals, derive insight from one stage of the customer journey and apply it across others.

NovaceneAI enables exactly this kind of insight aggregation: unifying data from across systems and applying AI on top to reveal actionable intelligence. When data moves freely across sales, onboarding, and success, interconnected insights emerge, revealing patterns, timing, and opportunities that were previously buried in a deluge of interactions.

While the conference showcased dozens of innovations, one presentation offered a clear snapshot of how financial institutions are executing on this concept. In the Power Panel: The CX Revolution, leaders from U.S. Bank and Citi described how they’re using AI to personalize engagement and embed intelligence into everyday experiences. Their examples showed a steady move towards contextual, data-driven journeys.

U.S. Bank is bundling onboarding, lending, and loyalty through offerings like Business Essentials for startups and Bank Smartly for consumers. By unifying early-stage onboarding with downstream lending and rewards, it’s starting to build continuous customer journeys.

Citi discussed how sales and experience are beginning to merge, embedding financing directly into merchant checkout flows. By using shared customer and partner data, Citi delivers contextual offers in real time, transforming service interactions into sales touchpoints.

Yet much of the data powering these insights remains trapped in function-specific systems, preventing the cross-pollination that true journey intelligence requires.

The Rise Of The Customer Journey Economy

The next evolution of CX is about creating connected insights across the entire revenue journey. As organizations move past personalization, a powerful advantage comes from systems that continuously aggregate, analyze, and adapt to customer sentiment. Insights no longer flow in a straight line from acquisition to retention but they skip back and forth, allowing patterns seen in one customer’s stage to inform decisions in another.

This shift defines what we call Customer Journey Insights: an environment where data from sales, onboarding, and success is aggregated, interpreted, and leveraged in real time. Instead of managing fragmented touchpoints, organizations focus on what customers need, why they engage, and when to act.

Our white paper, The New Growth Engine: Signals That Turn Customer Interactions into Revenue, breaks this down into three dimensions and four enablers. The three dimensions—What, When, and Why—represent the questions every growth system must answer. The four enablers—Flexibility, Intelligence, Usability, and Compliance—describe the foundations that make those answers operational and trustworthy. Together, they form a framework for turning raw interaction data into predictive and explainable insight.

Imagine a bank streamlining how it handles open opportunities based on insights surfaced automatically through ongoing win–loss analysis. By continuously detecting patterns across closed deals, the system might determine that proposals with simpler terms and faster approvals convert more reliably and recommend specific actions to improve active opportunities. Or sales teams being alerted to a new revenue opportunity surfaced during a customer success call, to ensure no potential lead is missed. That’s the essence of Customer Journey Insights: intelligence that compounds, and where every interaction reinforces the relationship.

How NovaceneAI Enables Customer Journey Insights

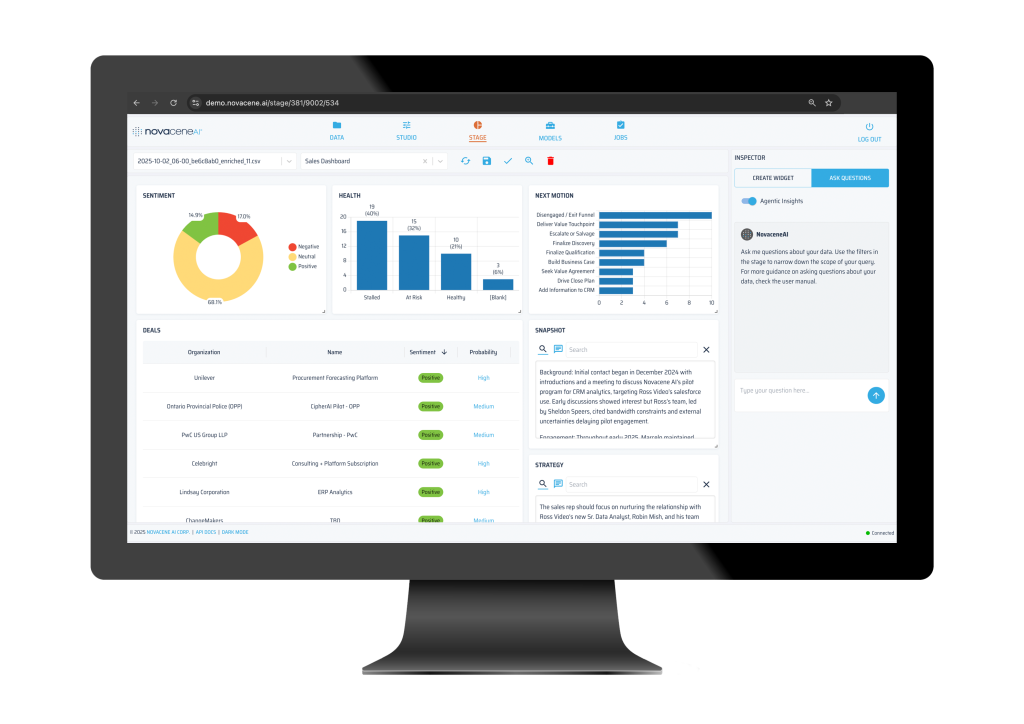

Data Aggregation: NovaceneAI makes Customer Journey Insights possible by aggregating structured and unstructured data from CRMs, CSAT and NPS surveys, social media listening tools, and more into a centralized place. It then applies explainable AI and machine learning to surface actionable and auditable insights, empowering sales and customer success teams with data-driven decision-making power.

Actionable Insight: NovaceneAI enables teams to explore insights through interactive dashboards and a conversational interface that answers key questions in plain language. This allows sales and customer success teams to drill into relationship nuances and uncover “a-ha” moments across the customer journey; turning unstructured conversations into strategic signals that reveal where engagement and growth converge.

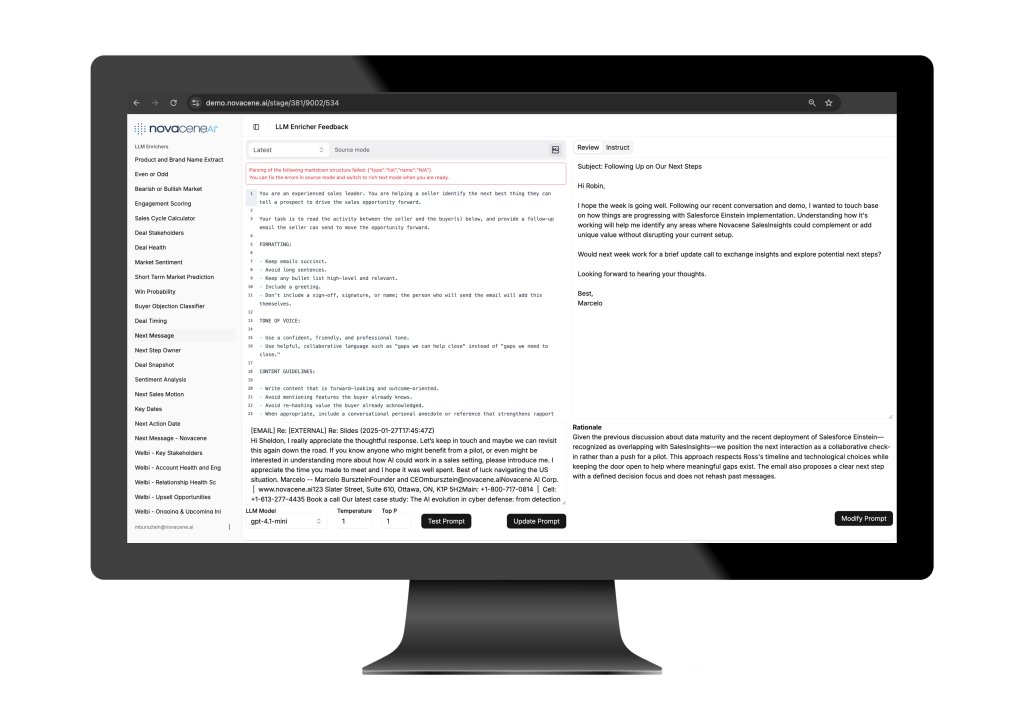

Expert Feedback: The platform includes a user-friendly interface that allows sales and customer success experts to provide feedback to the AI without writing code. Through this interface, experts can refine recommendations, validate insights, and continuously train the models to reflect their organization’s specific business dynamics. This collaboration between human expertise and machine learning ensures that recommendations remain contextual and aligned with each company’s unique sales process.

By enabling aggregation, explainable AI, human feedback, and exploration, NovaceneAI closes the loop between insight and action, moving organizations beyond personalization toward true, cross-journey intelligence.

The New Growth Engine

The convergence of sales and customer success marks a defining shift in how organizations grow. What once ended at onboarding now extends through every conversation, touchpoint, and renewal. Customer Journey Insights transform these interactions into a continuous loop of learning—where each signal refines the next action and every team contributes to growth. With NovaceneAI, that loop becomes visible, explainable, and actionable. These ideas also echoed through our recent discussions at DSS NYC, where industry leaders explored how AI is reshaping customer engagement from discovery to delivery.

Download The New Growth Engine: Signals That Turn Customer Interactions into Revenue to see how journey intelligence can redefine your organization’s approach to customer engagement.