Human-Governed Agentic AI Workflows for Financial Institutions

Turn fragmented legacy data into ongoing insights, without rebuilding existing systems.

The AI Adoption Gap in Financial Services

Financial leaders know AI’s potential to improve customer experience, automate operations, and enable faster decision-making. But most AI initiatives stall before delivering meaningful results.

The issue isn’t a lack of ambition or investment. It’s that critical data is fragmented across legacy systems, not yet ready for AI, and difficult to govern. As a result, AI models take longer to develop, outputs are difficult to explain and trust, and moving from analysis to action becomes slow and risky in regulated environments.

A Clear Path to Trusted, Operational AI

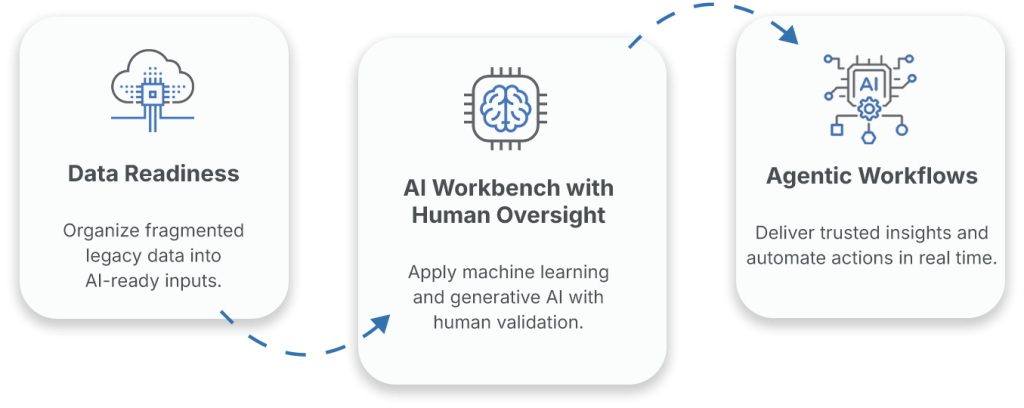

NovaceneAI provides a practical, low-risk way for financial institutions to move from fragmented legacy data to agentic workflows. The platform works on top of existing systems to unify data, allow human governance, and enable AI to operate safely in regulated environments.

By combining data readiness, agentic AI workflows, and human-in-the-loop oversight in a single platform, NovaceneAI helps teams move beyond pilots and dashboards to deliver measurable AI impact in weeks, not months, without costly internal rebuilds.

Key Benefits for

Financial Institutions

Human-governed agentic AI workflows

Deploy AI workflows with built-in human oversight, enabling subject-matter experts to refine outputs while maintaining explainability and auditability.

Turn fragmented legacy data into AI-ready foundations

Unify structured and unstructured data across existing systems so AI can operate reliably without large-scale internal rebuilds.

Faster time to value for AI initiatives

Move from pilot projects to operational AI workflows in weeks, not months.

Lower operational burden across teams

Enable AI workflows that continuously surface insights, reducing manual data preparation and ad-hoc analysis so teams can focus on higher-value work.

Financial Services Use Cases

NovaceneAI’s platform is well-suited for areas where fragmented data and governance constraints slow teams and limit their ability to act.

Customer Experience and Insights

Unify customer data across channels to surface real-time trends, sentiment, and journey insights that support personalization and retention.

Risk, Fraud, and Operations

Enable governed AI workflows that accelerate triage, monitoring, and analysis, helping teams respond faster while maintaining explainability and oversight.

Data and Analytics Modernization

Improve data quality and AI readiness across legacy systems without overwhelming internal engineering teams.

How the Platform Works

A simple, governed path from legacy data to AI-driven action.

Proven Results in Regulated Environments

NovaceneAI has delivered measurable AI outcomes in highly regulated environments where governance and trust are non-negotiable. These results demonstrate the value of governed, agentic workflows in practice.

95%

accuracy in data quality automation

20%

automation of cybersecurity alert triage within six months

94%

reduction in manual analysis work